WEAVING SUCCESS INTO YOUR BUSINESS

Technical Assistance Resource HUB

Your Loan Readiness Starts Here…

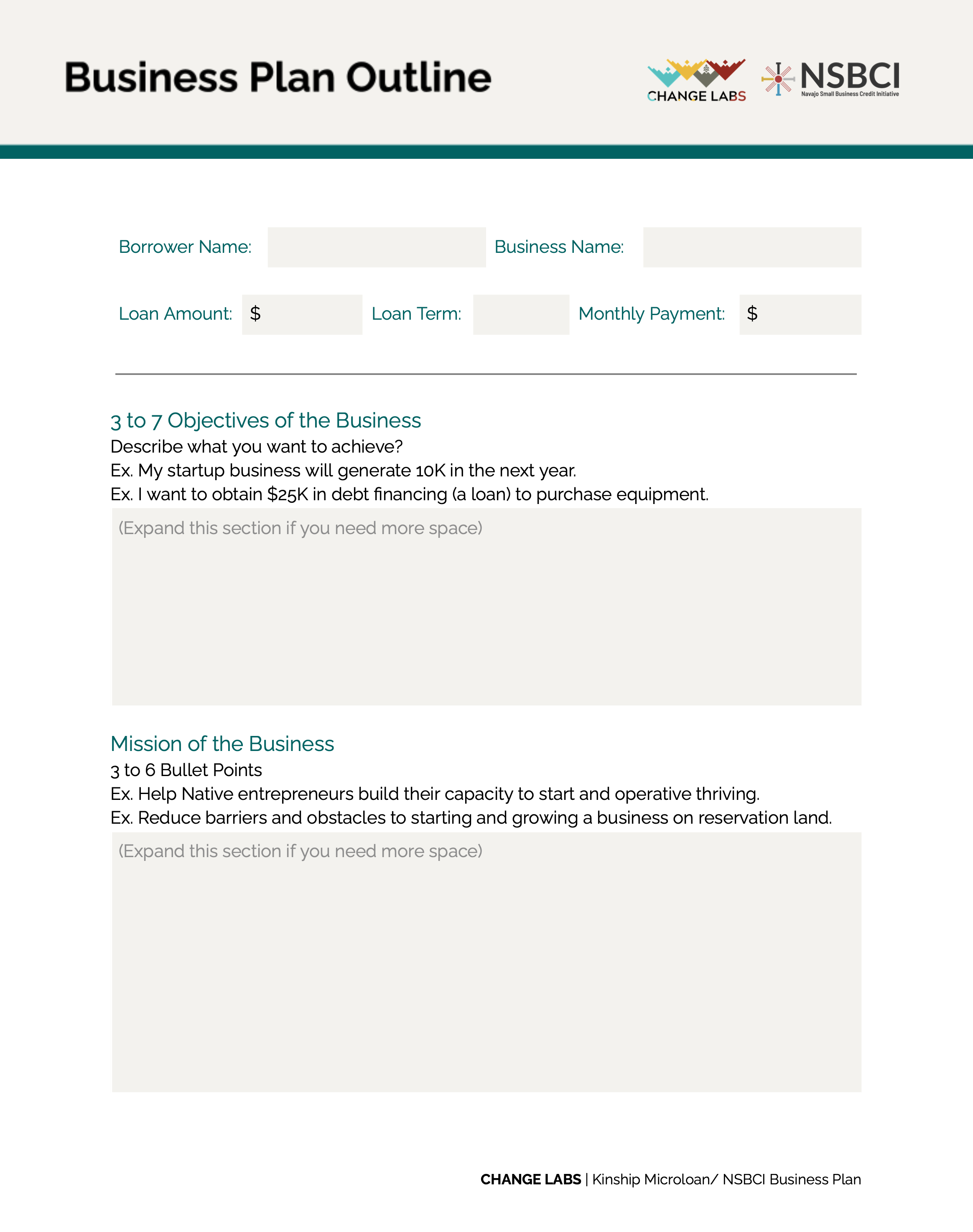

Regardless of loan size you will need to prepare the following for a completed loan package:

Business Plan or Business Model Canvas (50K below option)

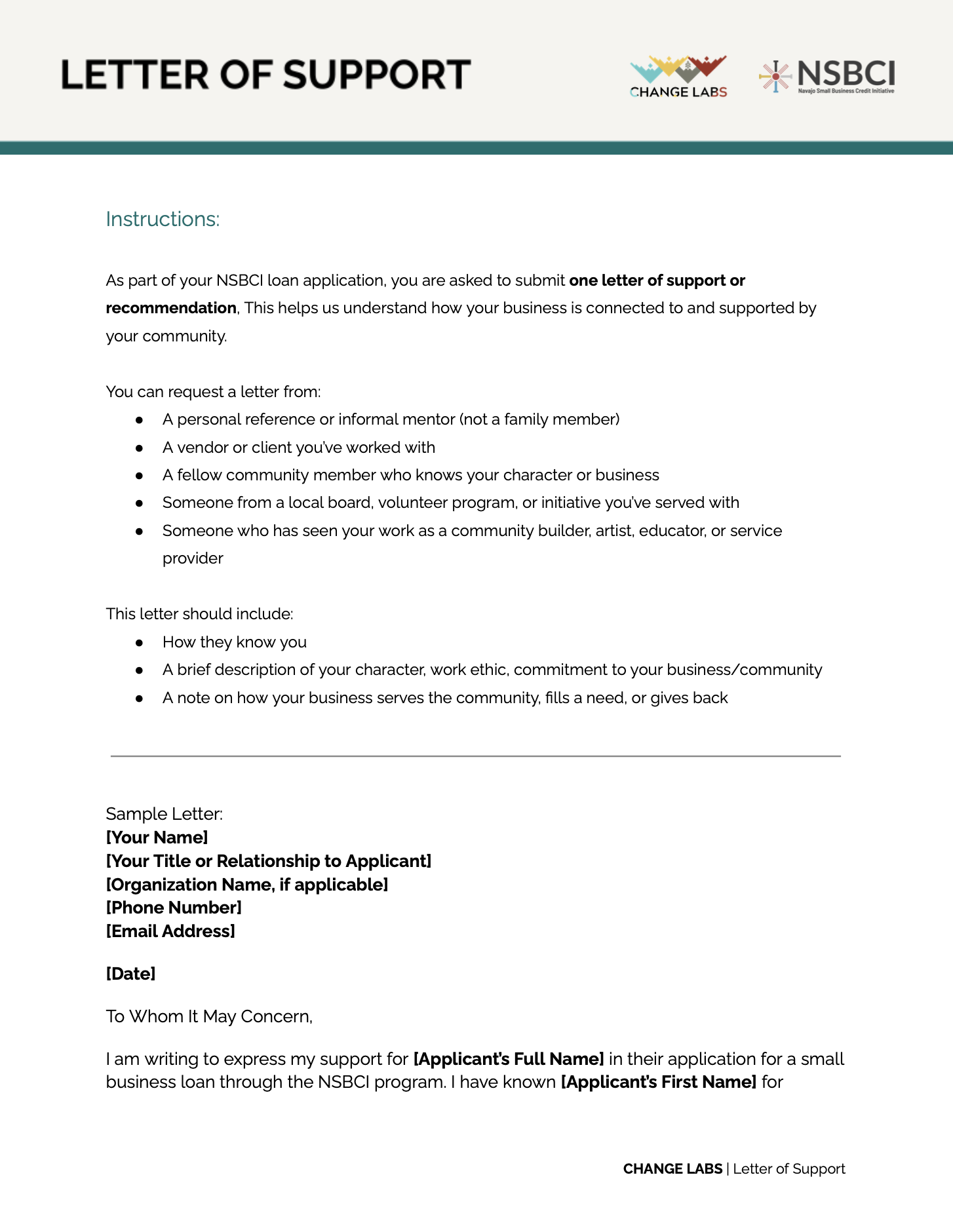

Letter of Support from vendor or client reference

Documentation of Owner Investment or sweat equity

Loan purpose clarity that is a clear usage with basic budget for loan or growth goals

Can demonstrate Tracking Financial System or evidence of Bookkeeping System

Mission alignment for loan that hits on all or at least one:

Growing a businesses operating on the reservation

Supporting a business employing Native People

Contributing to Native Wealth Generation

under $20,000

Household income

Basic or Startup Budget

$20,000 to $50,000

Profit & Loss Statement for 12 months

Balance Sheet for 12 months

Personal &/or Business Tax Returns

Cash Flow projection for 12 months

$50,000 to $1.5 million

Referral to Banking Partners

Financial Projections for 48 months (2 years)

Tax Returns

Financial Statements

Downloadable Templates

The Change Labs coaches are available for one-on-one coaching to support you with your next step.

Get more support

Coaching & Resources

-

Coaching is our way of supporting the entrepreneur on advising strategy or brainstorming ideas.

You can choose to meet with any coach to help you decide the next phase or step in your journey.

When finding a coach to best support your needs we have outlined the “verticals” in which our coaches are Change Makers.

Book a Session Below. If you would like 2 coaches to be in your session please email them directly about making arrangements.

-

Your business structure impacts how your business is taxed, business ownership, how you obtain financing, the transfer of assets and ownership interests, your personal liability, and how you manage and run your business. A business lawyer can always provide guidance. The structure you choose also impacts what entities you will need to register your business with.

Some common business structures:

Corporation

Non-profit Corporation

Cooperative

LLC (Limited Liability Companies)

Sole Proprietorship

Partnerships

Need more info on LLCs? Check out this talk from Joe Austin! -

An EIN number is required for a business that will be employing employees other than the owner. In many cases, EIN numbers are required to open a business bank account and needed to pay federal taxes for your business. It may also be required on business loan applications. financial papers, and submissions to grants.

Applying for an EIN is simple, free, and is done online within minutes through the IRS. However, if you do not have a physical mailing address, you’ll first need to secure a statutory or registered agent, which can be a friend or relative in your State with a physical mailing address who is willing to receive business communications on your behalf. Talk to your coach about the role of a registered agent if you don’t have a physical mailing address.

-

All business structures are required to register with a US State and/or a recognized tribe, except for sole-proprietors. Sole-proprietors are liable for sales tax and should register with their local tax agency, but they do not need to file articles with a State or Tribal agency.

We’ve created an online tool, Build Navajo, to support entrepreneurs with the business registration process on the Navajo Nation. Your coach can support you through this process.

If you operate your business on a reservation, you can choose to register with both the tribe and the US State where your business is located.

Here’s a link to the steps to starting a business in Arizona.

Here’s a link to the steps to starting a business in New Mexico.

Again, your coach can help you interpret the steps and understand what’s needed to file your paperwork.

-

The majority of nonprofits in the US are 501(c)(3) which is a corporation organized not-for-profit. Unlike a for profit corporations, a nonprofit organization is not “owned” by the founder and is organized and operated for a collective, public or social benefit. Whereas a for profit corporation operates as a business aiming to generate a profit for its owners.

Any revenues of a nonprofit that exceed expenses must be committed to the organization's purpose, not taken by private parties.

If you’re undecided between a non-profit vs. a for-profit structure, ask yourself these questions:

1) Will your business activity serve a public or social benefit that is religious, educational, charitable, scientific, literary, or prevent cruelty to children or animals?

2) Will you be generating profit to fulfill a purpose?

3) Do you anticipate needing grant money or donations in order to do the work?

4) Do you want to protect directors, officers, and members from personal liability for the corporation's debts and liabilities?

If you answered “Yes” to all of these questions, you may be suited for a non-profit corporation structure.

-

Getting started on the right foot with your business financials starts with your personal financials.

Check out this YouTube Workshop by Change Labs on Applying for Credit!

As general rule of thumb… separating your personal and business income & expenses can make tax payment and running your business smoother.

Even if you’re planning on staying a sole proprietor, there are multiple ways separating these accounts from another savings account to a recording of separate ledgers (paper/digital spreadsheets).

Getting a business loan starts with having a business banking account. Most credit unions and major banks require for an EIN number & Articles of Organization (LLC Paperwork) to open a banking account. The process of requesting a business loan starts with a general application and vary from other requirements of:

Business Plan

Financial Projections (~2 Years) or Cash Flow Projections

Business Paperwork

~2 Years of Taxes (Personal if startup)

Profit & Loss Statements

Collateral Worksheets*

*depending on the type of loan to size of loan majority of financing requires 95% of loan to be collateralized with assets. (i.e. $10,000 loan $9,500 worth of collateral)

What does a business loan help with besides working capital or financial support? It helps build business credit!What does business credit do and why would a business need it?

Similar to personal credit, business credit establishes its ability to borrow. Business Credit is used to help qualify for loans and other forms of financing. For example, building and being in good business credit standing can open opportunities for your business to open a business credit card or apply for other business loans for business expansion, day to day expenses, purchase inventory, hire additional staff or have working capital for the cost of doing business.Talk with a Kinship Lending Coach about business loans or other questions on personal financials.

-

Item descriptionBusiness Type:

1. Sole Proprietor

2. Partnership

3. CorporationFederal Tax Identification Number

EIN = Employer Identification NumberEmployee Forms:

W-2 : report wages paid to employees and the taxes withheld from themW-4: completed by an employee to indicate his or her tax situation to the employer. The W-4 form tells the employer the correct amount of federal tax to withhold from an employee's paycheck.

W-9: a third party who must file an information return with the Internal Revenue Service. It requests the name, address, and taxpayer identification information of a taxpayer.

Resources:

Navajo Nation Business Regulatory Office

Navajo Office of Tax Commission

IRS

Arizona Dept of Revenue

NM Dept of Revenue

Need Professional Support?

Interested in working together? Fill out some info and we will be in touch shortly! We can't wait to hear from you!

Visit the Change Labs YouTube channel

Access 100+ workshops and seminars led by Native entrepreneurs on business topics ranging from storytelling to filing taxes.